Star Entertainment Group, one of Australia’s premier casino operators, is navigating a challenging period marked by regulatory pressures and financial instability. Known for its prominent casino properties, Star faces a confluence of setbacks that include declining revenues, strained liquidity, and the fallout from ongoing investigations into its operations. The company’s efforts to stabilize and restructure are under intense scrutiny from investors, regulators, and the public, as it seeks to restore confidence in its brand.

During the company’s recent annual general meeting, Steve McCann, who has taken on the role of CEO amidst this turbulence, acknowledged the significant hurdles ahead. Star’s financial performance has been deeply affected by the implementation of cashless gaming—a measure aimed at improving compliance and reducing risks such as money laundering. However, this shift has disrupted customer behavior, leading to a decline in visitation and player spending. The September quarter saw an $18 million operating loss, with revenue dropping by 18% to $351 million. Such figures highlight the immediate challenges Star faces as it grapples with a complex mix of operational and regulatory demands.

Star’s cash reserves have also diminished, raising concerns about the company’s liquidity and ability to meet its short-term obligations. To mitigate these financial pressures, Star has indicated that it is exploring several options. These include securing additional funding, potentially through capital raising or loans, and cutting costs across operations. However, these measures alone may not suffice in addressing the deeper, systemic issues the company faces.

The regulatory challenges confronting Star are rooted in allegations of historical misconduct. Reports of money laundering and lax compliance at its casinos have led to regulatory investigations, fines, and a tarnished reputation. This scrutiny comes as part of a broader push within Australia’s gaming sector to enforce higher standards of integrity and accountability, with regulators cracking down on perceived misconduct across the industry.

In response to these challenges, Star has embarked on a series of reforms. These include overhauling its leadership team and implementing a decentralized operational structure intended to improve accountability. The company is also strengthening its compliance and risk management frameworks to align with stricter regulatory expectations. These steps are part of an effort to rebuild trust with stakeholders and demonstrate a commitment to ethical business practices.

While these initiatives are necessary for long-term stability, Star’s path to recovery remains fraught with uncertainty. The ongoing investigations and potential for further legal proceedings could exacerbate its financial strain and prolong the reputational damage. Additionally, broader economic factors, including inflation and changes in consumer behavior, may compound the difficulties in revitalizing its operations.

Despite these challenges, Star’s leadership remains optimistic about the company’s ability to weather the storm. Steve McCann has emphasized the need for a strategic pivot that prioritizes sustainable practices and customer protection. By embedding robust anti-money laundering measures and fostering a culture of responsibility, Star aims to rebuild its standing in the eyes of regulators, customers, and investors.

The role of responsible gambling and customer safety is central to Star’s recovery strategy. Industry observers note that the company’s commitment to addressing problem gambling and promoting ethical gaming practices will be critical in restoring trust. Initiatives such as cashless gaming, while initially disruptive, could help Star demonstrate its dedication to transparency and security in the long term.

Analysts and investors are closely monitoring Star’s progress as it implements these measures. The outcomes of regulatory reviews and the company’s ability to stabilize its financial performance will significantly influence its trajectory. Some analysts believe that Star’s focus on structural reforms and compliance could position it for a more sustainable future, while others caution that the road ahead will likely be arduous and protracted.

As Star Entertainment works to navigate this challenging period, it serves as a case study in the complexities of operating in a heavily regulated industry. Its experience underscores the importance of balancing growth ambitions with ethical practices and regulatory compliance. For Star, the stakes are high, and its journey will likely shape perceptions of Australia’s gaming sector for years to come.

Related posts:

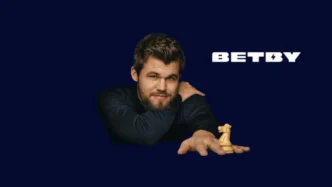

Betby Partners with Magnus Carlsen for “Make Your Move” Campaign